article

0

0

15105

15105

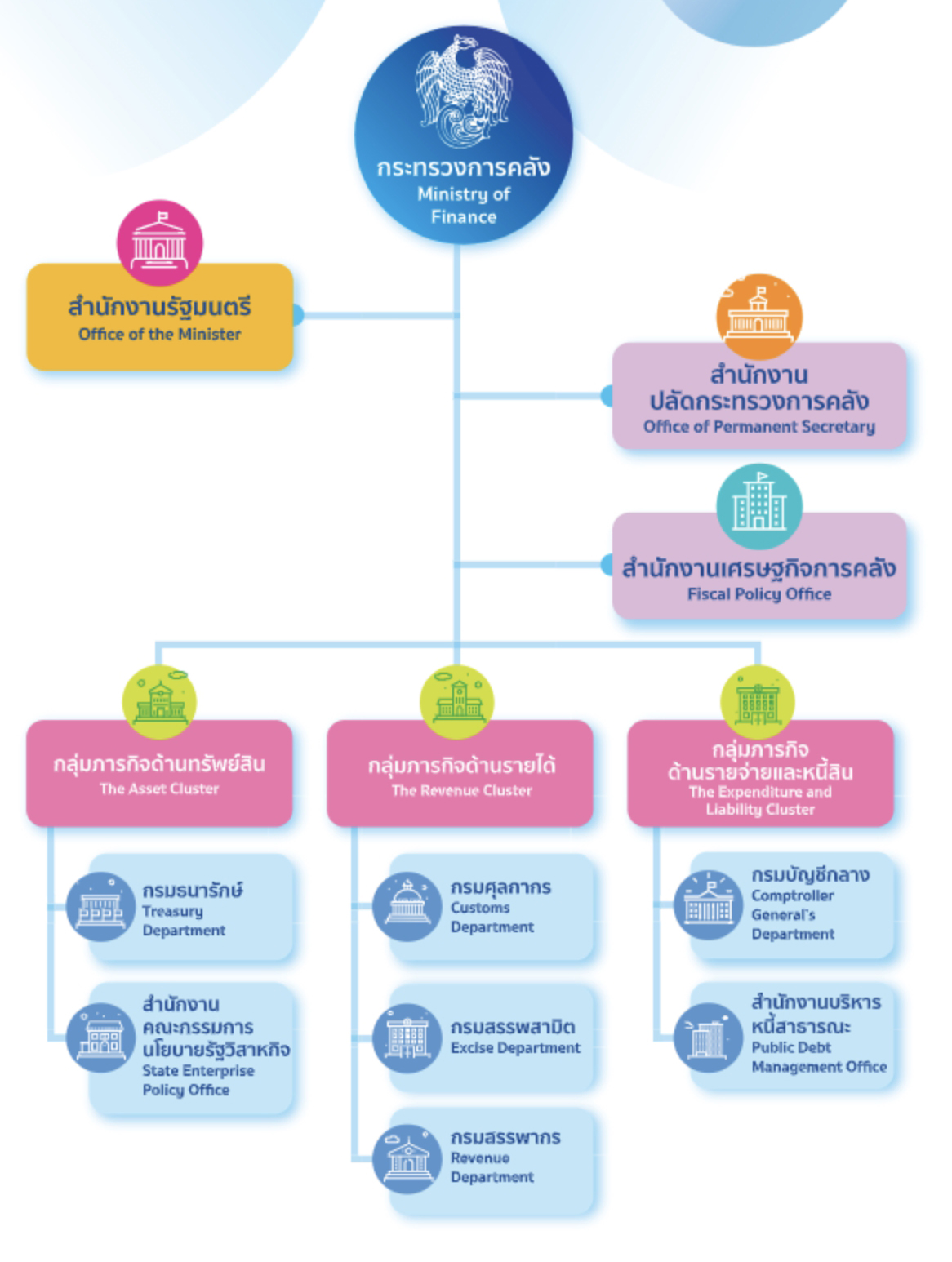

Organization Structure

The Duties and Responsibilities of Government Agencies and State Enterprise under the Ministry of Finance

These are as follows:

1. Government units not under a cluster

Office of the Minister ( https://ofm.mof.go.th )

is responsible for providing support and coordination as assigned by the Minister, political coordination, liaison with the Parliament and handling of Parliamentary enquiries, maintaining the Minister’s meeting diary, and monitoring of issues, comments and complains related to administrative policy.

Office of the Permanent Secretary ( https://palad.mof.go.th )

is responsible for formulating ministry’s strategic plan the oversight of regular duties, coordinating departmental inspections, provision of news and public information in general and implementation of matters concerning civil servants’ disciplines, and carrying out official duties that do not fall under any other government departments.

Fiscal Policy Office (FPO) ( http://www.fpo.go.th )

is responsible for proposing and identifying fiscal and financial policies and measures, including those concerning macroeconomics,and international finance with an aim to increase competitiveness and promote sustainable economic and social development as well as enhancing awareness, understanding and acceptance of the policies and performance to target groups, the general public and other entities, both domestic and foreign.

2. Asset Cluster

Treasury Department ( http://www.treasury.go.th )

is responsible for production of coins and Royal Decorations, conservation, storage, display, and dissemination of knowledge about the valuable state property, utilization of state land. Other responsibilities include the control of coin exchange and storage, withdrawals and deposits of provincial treasury reserve, control of the balance of the Government’s savings deposit at the Bank of Thailand, as well as pricing and appraisal of real estate and other properties as stipulated by relevant laws.

State Enterprise Policy Office (SEPO) ( http://www.sepo.go.th )

has the responsibilities of proposing policies of finances, accounting, remunerations and benefits for state enterprises, state revenue remittance, improving the efficiency of state enterprises, provision of a performance evaluation and good governance, and privatization.

3. Revenue Cluster

Customs Department ( http://www.customs.go.th )

is responsible for collecting custom, duties for inbound and outbound goods, other fees and collecting taxes on behalf of the Revenue Department, Excise Department and Ministry of the Interior. As these are the state revenues, it is imperative that measures to prevent and suppress tax evasion and goods smuggling be practiced. Other responsibilities include promotion of export through favorable taxation measures and provision of services to importers and exporters of goods in response to the government’s policy to promote international trade and facilitate the exporting process.

Excise Department ( http://www.excise.go.th )

is responsible for collecting taxes from certain types of products, both manufactured domestically and imported from foreign countries such as taxes on liquor, personal service business establishments, applying stringent control measures and penalty on the offenders of the law.

Revenue Department ( http://www.rd.go.th )

the primary agency responsible for the collection of taxes as a source of revenue for the government which is spent on the development of the country, governing and auditing of tax compliance, tracking and expediting tax payments in arrears, representing the government in maintaining fairness and tax law enforcement, making amendments and improvements to the legislation and taxation system to promote savings, investment and competitiveness in production and exportation with other countries. Revenue Department is also responsible for creating a fair distribution of income with a view to enhance voluntary tax payment. In addition, there are agreements made with various countries to eliminate double taxation to support trade and in-vestment between these countries.

4. Expenditure and Liability Cluster

Comptroller General’s Department ( http://www.cgd.go.th )

is the central agency who sets the standards, guidelines and practice for the legal aspects of finance and accounting, government purchasing and procurement activities, internal auditing, remuneration and benefits, management of government employees and any misconduct. It controls the disbursement of funds and manages expenditures of budgeted and off-budget funds in accordance with the discipline and fiscal sustainability, effectively manages cash and revenue and income using modern technologies, provides administrative support at the regional level, enhances the financial capability of government personnel and acts as the center of fiscal information.

Public Debt Management Office (PDMO) ( http://www.pdmo.go.th )

is responsible for setting policy and planning overall liabilities, conducting matters concerning public debt commitments, both domestic and foreign, managing public debts, both in the risk aspect and cash, maintaining the government debt database, drawing and disbursing of loans and repayments, developing a process for performance monitoring and evaluation, implementation of laws and regulations, as well as the development and revision of commitments and public debt management and the development of the country’s bond market.

Next Page >>

Tweet

Tweet Share

Share Google+

Google+ Email

Email